Specialised Asset-Based Finance

In 2003 Via Capital was ranked 7th in the world by the Export Import Bank of the US in terms of aircraft financing, and 10th in the world in respect of all asset-based finance.

In 2003 Via Capital was ranked 7th in the world by the Export Import Bank of the US in terms of aircraft financing, and 10th in the world in respect of all asset-based finance.

In addition, Euromoney’s Airfinance Journal awarded Via Capital a “Deal of the Year” award for the Rand-denominated export credit financing of five Boeing 737-800 aircraft.

Via Capital has arranged some R6 billion of aircraft financing for South African borrowers since 1999 (mainly larger narrow-bodied airliners). Via Capital has also undertaken cross border shipping finance transactions.

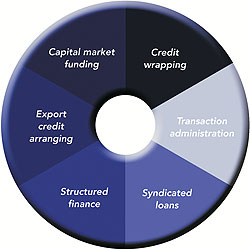

A key element of Via Capital’s market positioning in asset-based finance is the Eagle Bonds export credit financing platform. In addition to the Eagle Bonds medium term note issuance programme, Via Capital operates a programme of short term paper issued out of a second Eagle Bonds conduit – with a more standardized product offering to appeal to smaller transaction sizes.

Via Capital prefers to show debt funding opportunities arising from its asset-based finance transactions to the capital markets. However, where the complexity or underlying business needs make this difficult, Via Capital will place the debt with any one of the various banks with which it has well developed relationships.

For qualifying transport asset acquisitions of R50 million and above Via Capital is uniquely positioned to arrange the necessary financing in a creative, efficient and value added manner.